Stay Relevant

Real Numbers clients care about

Sustain Trust

“Not Yet” proves you’re watching

Build Anticipation

As refinancing gets closer, tell them

First to YES

Leave them zero reason to look elsewhere

“You have the relationship advantage.”

Stop losing loans that should be yours

Why Do Past Clients Refinance With Other Lenders?

“I already

refinanced with

someone else.”

They get there before you

They’re more persistent

They feed FOMO

They exploit sales tactics

They’rebuilt for refinances

Autopilot neutralized the competition

Refi-Autopilot: Your Perfect Assistant

Peace of mind. Knowing every opportunity is being watched - daily

- It’s mining your database for you

- Automatically adding, removing, and updating clients via your LOS

- Telling you when nothing is needed (most days), or

- Highlighting specific clients who do need your touch

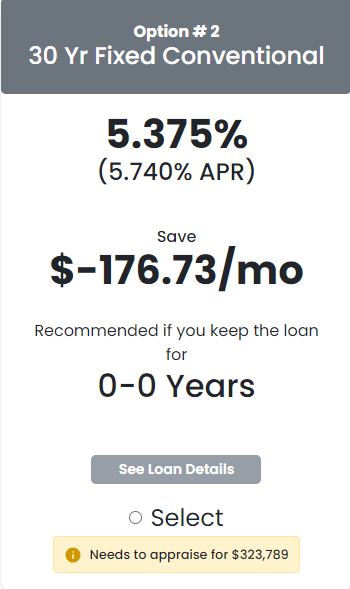

Convenience. All the number crunching is already done

- This isn’t an alert that someone might make sense to refi

- It’s the actual numbers down to the penny

- Including your pricing, lender fees, third party fees, etc…

Confidence. Ensures lending rules are met

- It considers all the rate options,

- Removing those that don’t meet lending rules

Clarity. Analyzes everything and recommends at most two options

- Provides the client with choices, but not an overwhelming amount

- Tailored to what they say is important to them

Freedom! Automatically sends all of this to the client for you, every month

- Establishes the trust that you’re really watching

- Tells them when it doesn’t make sense,

- So when it does, they believe you

- Freeing up your time to focus on what’s important in life.

How Autopilot Does The Work For You

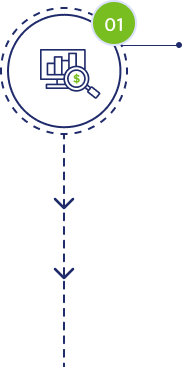

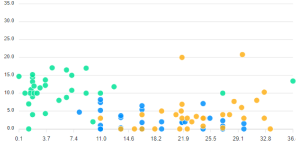

Analyzes the refinance potential in a simple format - Every day

For every past client, every day

Personalized to their unique scenario

Using your actual pricing

Showing you what your pipeline is, and what it

could

be

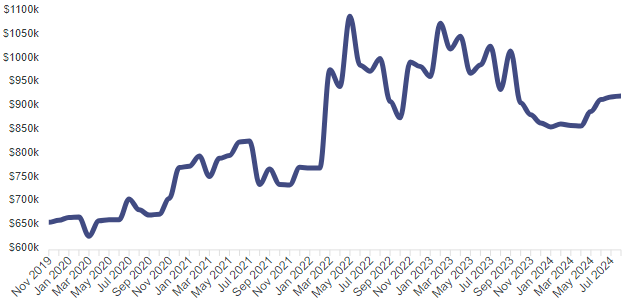

Proactively answers the questions the clients really want to know – Every Month

How much will I really save?

Is now a good time?

Can I get Cash Out?

Is my house value going up or down?

Even when it doesn’t make sense to refi

Builds the client’s anticipation with over 30 unique alerts depending on their trend and interaction

Whenever they improve or

The Fed did something

They see that you’re watching, literally

daily

Creating an interest score for each

borrower

So you know who’s interested and who’s not

67

Calls them to action the day they turn “Green”!

They get the numbers and alert that day

Gives you a great excuse to touch base

They see that you’re watching, literally

daily

No opportunity is missed

You’re in the

Green

They say “Yes”

The sale has been done for you,

The numbers are already accurate

All that’s left is to ensure they qualify

(updated income, credit, etc)

Then lock in the loan and turn it over to

processing.

Yes, I’d like to Refinance

to this Lower Payment

Our Clients Says